May 22, 2024

Introduction

In 2025, the costs of climate change for industrial companies are a measurable reality :

1 trillion dollars of risks by 2030 (source : CDP).

44.5 billion euros/year of losses in Europe (source : European Environment Agency).

Yet, only 24% of industrialists measure their Scope 3 emissions (EcoVadis/BCG, 2025), and even fewer assess the social, geopolitical, or climate risks on their value chain.

The solution? A holistic approach combining Life Cycle Assessment (LCA) and multi-dimensional risk analysis (social, geopolitical, climate, etc.). This is precisely what Sapiologie proposes.

We are experiencing a period of great changes

The world is in constant change. These changes are multiple and tend to accelerate.

The climate is changing faster and faster

Social inequalities are exacerbating, and social scandals are becoming more frequent

Resources are dwindling

The global geopolitical situation is tense

Moreover, there are numerous negative feedback loops in these world developments. The most vulnerable populations are the most exposed to climate change, which contributes to accelerating their precarity. The reduction in resource availability affects these vulnerable populations more severely, as they are not equipped to play the market game.

Furthermore, they generally benefit the least financially from resource exploitation.

All these injustices create the breeding ground for political and geopolitical instability.

The more linear and globalized the value chain, the greater the risk

Globalized value chains are generally:

opaque, thus with a high social risk and a strong reputational risk

transport-intensive

sensitive to geopolitical changes

sensitive to climate change

And this is regularly observed in the news:

3. The supply chain: the blind spot of companies

Supplies (scope 3) represent 80 to 90% of a company's total carbon footprint.

On a product scale, they account for an average of 85% of the environmental impacts of the product over its entire life cycle

Only 24% of companies measure their scope 3 emissions, and even fewer assess the social, geopolitical, or climate risks on their value chain. (EcoVadis/BCG, 2025)

Companies have a very poor understanding of their value chain, which is partly why they struggle to measure and thus reduce their scope 3 emissions, as well as their exposure to the various risks mentioned above.

The cost of inaction is substantial

More than 200 of the world's largest listed companies anticipate that climate change could cost them almost 1 trillion dollars (888 billion euros) in total, largely in the next five years, according to a report from the CDP organization.

This represents 15 to 20% of the EBIT of companies in the S&P 500

Anticipation as a lever for competitiveness

Potential opportunities worth 2.1 trillion dollars (CDP)

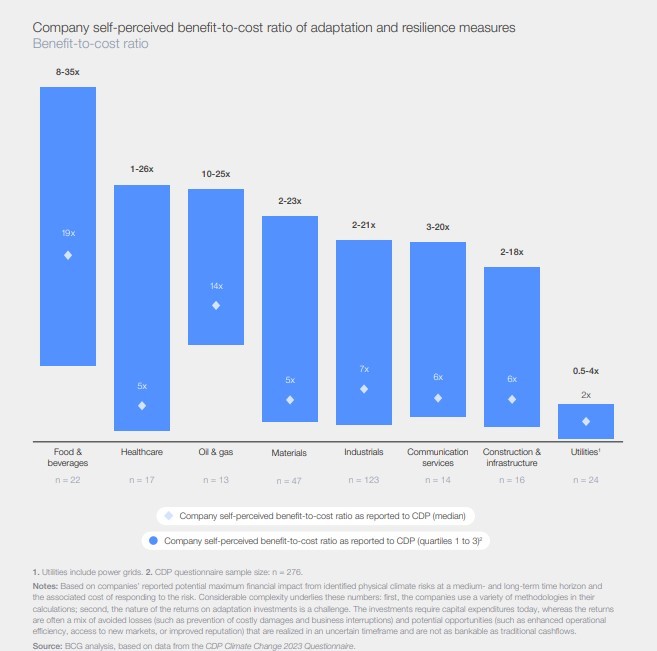

Up to $19 of losses avoided for every $1 invested in adaptation or decarbonization. (WEF and BCG)

Cost-benefit report of adaptation and resilience measures perceived by the companies themselves Source: The Cost of Inaction: A CEO Guide to Navigating Climate Risk, WEF and BCG, December 2024.

Get moving now with Sapiologie:

Create a comprehensive mapping of the impacts and risks of your offering

Identify the portion of your revenue at risk

Identify the most critical products and suppliers in terms of environmental impacts and exposure to risks

Simulate the impacts of your decisions

Design a sustainable and resilient company and value chain

Request a demo